Plan Your 2026 Travel Calendar Like a CEO

CEOs don’t plan travel impulsively. They plan it strategically.

For entrepreneurs, consultants, and creative leaders, travel isn’t just a break from work — it’s part of how the business runs. Conferences, retreats, content trips, and planning resets all serve a purpose when they’re designed intentionally.

The difference between expensive travel and tax-smart travel is planning — and the earlier, the better.

If you want 2026 to feel calm, organized, and aligned, your travel calendar should be built the same way you build your business.

Why CEOs Plan Travel a Year Ahead

Planning early isn’t about rigidity — it’s about control.

When you plan travel in advance, you:

• Choose trips that support business goals

• Create clearer documentation for deductions

• Lock in better pricing and availability

• Avoid last-minute, emotionally driven travel decisions

• Build space for both growth and rest

Travel becomes a tool, not a distraction.

What Counts as Business Travel (and Why It Matters)

Business travel isn’t limited to conferences.

For many business owners, deductible travel can include:

• Industry conferences and masterminds

• CEO retreats or planning offsites

• Content creation trips tied to your brand

• Client meetings or partner travel

• Strategic planning weekends away from home

The key is intent and documentation — not how “fun” the trip looks.

When travel supports revenue, growth, or operations, it belongs on your business calendar.

The CEO Way to Build a 2026 Travel Calendar

Instead of booking randomly, build your travel year with structure.

Step 1: Define Your Travel Categories

Before choosing dates, identify why you’re traveling.

Common CEO travel categories:

• Growth (conferences, education, masterminds)

• Strategy (planning retreats, CEO resets)

• Content (brand shoots, campaigns, launches)

• Relationships (clients, collaborators, partners)

• Rest (intentional downtime tied to business sustainability)

Each trip should fit at least one category.

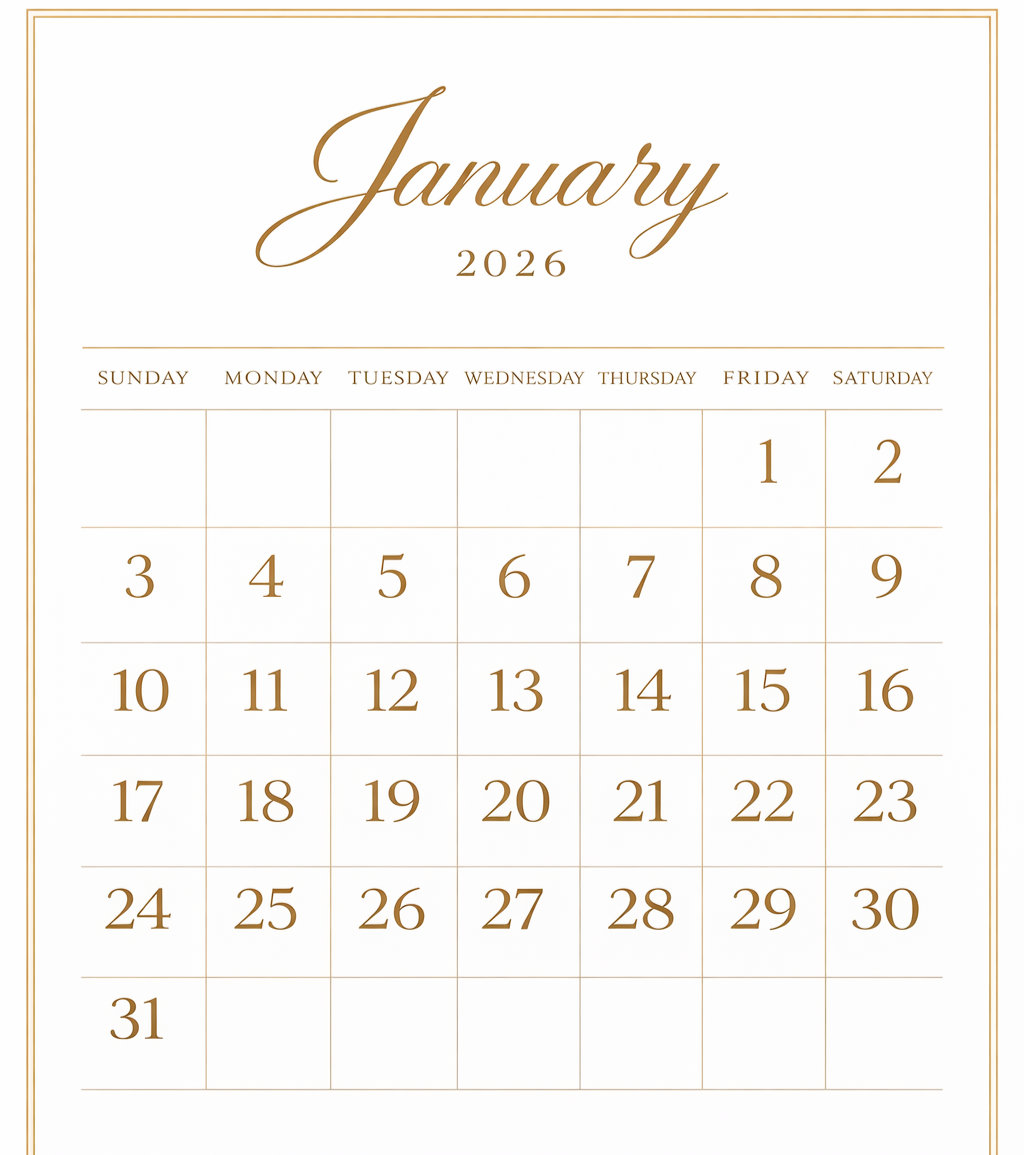

Quarter 1–Quarter 4 Travel Planning Framework

Q1: Strategy & Positioning

Best for:

• Annual planning retreats

• Industry trend conferences

• CEO clarity resets

Why it matters:

Q1 sets the tone for the entire year — and early planning trips are easier to justify strategically.

Q2: Visibility & Growth

Best for:

• Conferences

• Speaking engagements

• Networking events

• Brand collaborations

Why it matters:

This is prime time for relationship-driven travel that supports growth and revenue.

Q3: Content & Creativity

Best for:

• Content trips

• Brand shoots

• Campaign creation

• Location-based storytelling

Why it matters:

Content created in Q3 supports fall and holiday marketing — and travel tied to content is often deductible.

Q4: Review & Reset

Best for:

• Year-end CEO retreats

• Business review trips

• Tax planning resets

• Quiet reflection

Why it matters:

Q4 trips support planning, closure, and preparation — and may impact year-end tax strategy.

When to Book for the Best Tax & Financial Strategy

Smart CEOs book with intention.

Best practices:

• Book flights and hotels through your business account

• Keep itineraries, agendas, and receipts

• Tie travel dates to business purpose clearly

• Plan deductible travel before the year ends

• Avoid mixing personal travel without documentation

Early booking also:

• Reduces cash-flow stress

• Allows better budgeting

• Creates clearer bookkeeping

How Travel Fits Into a Tax-Smart Life Design

The goal isn’t to travel more —

it’s to travel better.

When your travel calendar is intentional:

• You avoid burnout

• You build your brand naturally

• You document deductions cleanly

• You lead with clarity, not chaos

This is what working smarter from anywhere actually looks like.

Your 2026 travel calendar isn’t a wish list — it’s a leadership tool.

When you plan travel like a CEO, you:

• Align growth with lifestyle

• Protect your energy

• Support your tax strategy

• Design a business that works with your life

That’s the OOO way

Work Smarter. Travel Better. Deduct Responsibly.