Travel Content That’s Deductible: How to Document Smartly

Turning Travel Into Business: The Smart Way

Traveling for your brand isn’t just fun — it can also be financially smart. When you create content that directly supports your business (think vlogs, brand partnerships, or strategy planning trips), many of those expenses can become deductible.

But here’s the catch: the IRS cares less about how exciting your trip was and more about how well you document it.

What Counts as “Business Travel”?

To qualify as business travel, your trip must have a primary business purpose. That means more than just snapping one photo for Instagram and calling it a day.

You should be:

Creating business content — filming reels, writing blogs, or meeting collaborators.

Networking or meeting clients.

Attending workshops, conferences, or brand shoots.

Researching future business opportunities or destinations.

If you can show that your travel directly supports your income or brand growth — you’re in the deductible zone.

Document Everything Like a Pro

Here’s what to track so your business trips stay audit-proof:

1. Keep Receipts Organized

Hold onto receipts for flights, hotels, meals, excursions, and local transportation. Use folders or a digital app like Expensify or QuickBooks Self-Employed.

💡 Pro Tip: Create a folder named “2025 Business Trips” with subfolders by destination.

2. Track Your Business Days

Write down what you did each day. Example:

“Day 2 – Filmed content for brand collab + outlined Q4 strategy blog.”

If 4 out of 7 days are business-related, those 4 days (and related expenses) may be deductible.

3. Keep Proof of Purpose

Save screenshots of:

Brand emails or DMs confirming collaborations.

Storyboards, notes, or scripts.

Calendar invites or event confirmations.

4. Separate Business vs. Personal

If you extend your trip, only count the business portion. For example, a 5-day workcation + 2-day beach stay means 5 days are deductible — the rest is personal.

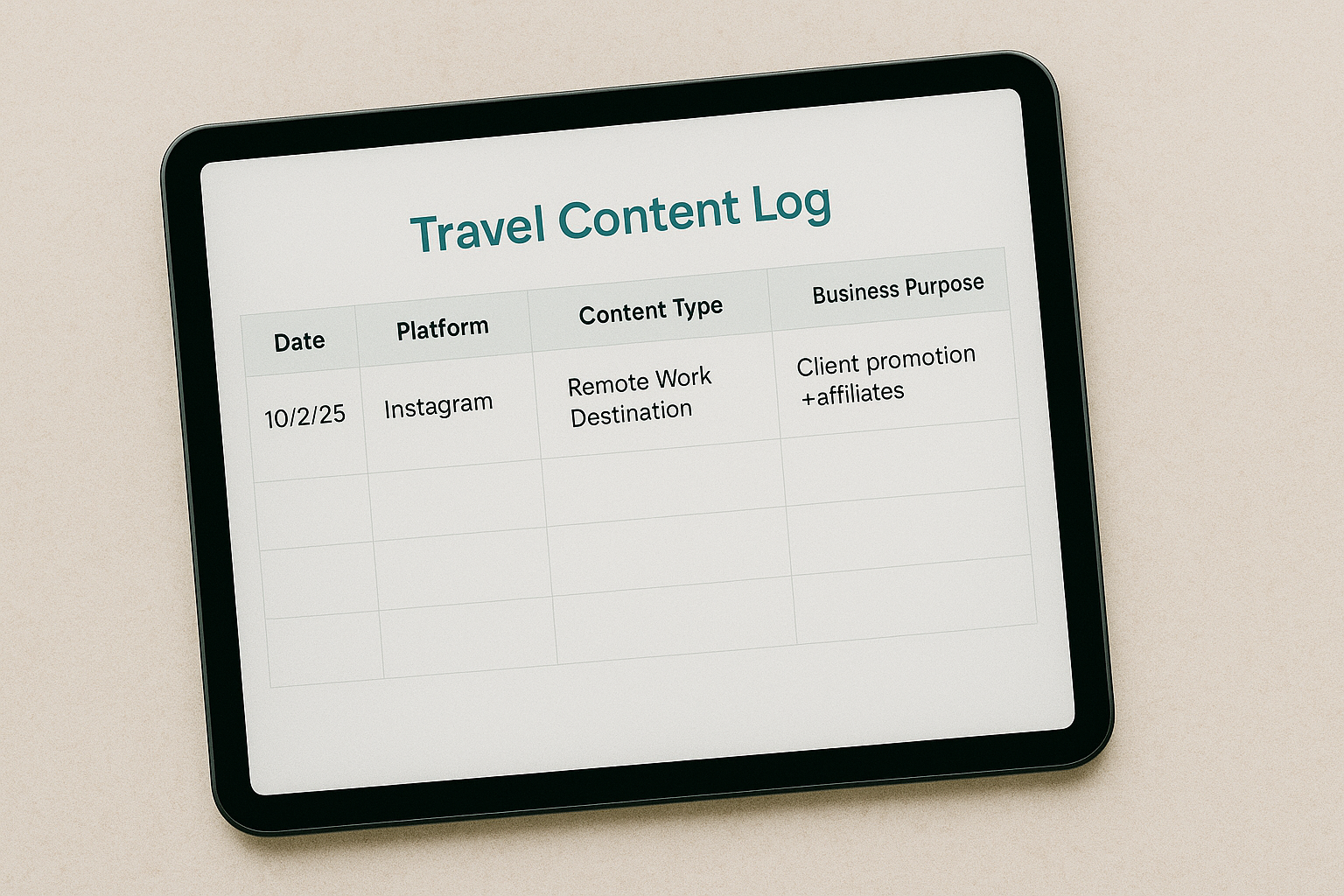

For Content Creators & Influencers

If your trip results in published content — YouTube videos, blogs, reels, or podcasts — document it all.

Keep a simple log like this:

Date-Platform-Content Type-Topic-Business Purpose

-10/2/25-Instagram Reel-“Work From Anywhere Setup-”Brand awareness + affiliate link

-10/4/25-Blog Article-“Tax-Smart Travel”-Educational content for audience

This simple record turns your creativity into proof of business intent.

Examples of Deductible Travel Content

✅ A content shoot in Aruba promoting your business services

✅ A vlog series about tax-smart travel (linked to your business niche)

✅ A CEO retreat or mastermind trip

✅ Travel for client meetings or brand collabs

🚫 Not deductible: a fully personal vacation or any trip with no real business documentation.

Keep Your Systems Simple

You don’t need fancy software to stay compliant. You just need:

A dedicated business bank account

A receipt tracking method (Google Drive or bookkeeping app)

A digital travel log or calendar

A habit of uploading receipts within 24 hours

The more you automate, the more deductions you can confidently claim.

Closing Thought

Traveling for business should be fun and strategic. Every flight, meal, and hotel night can serve your brand when you document smartly.